With prices continuing to rise, did you know you can take advantage of a temporary lower rate to help acclimate to your payments? The market is filled with first-time buyers anxious to own a home, …

A Mortgage with No Appraisal Needed? That’s a Home Run!

The low to mid-priced housing market today is on fire. There are many more buyers than sellers. The limited housing inventory has resulted in bidding wars that are driving up prices. In many areas, …

Continue Reading about A Mortgage with No Appraisal Needed? That’s a Home Run! →

Top Five Things Realtors Hate About Buyers

The spring and summer buying season has been incredibly busy. With so much competition from buyers for the limited inventory on the market, it’s more important than ever that buyers have a good team …

Continue Reading about Top Five Things Realtors Hate About Buyers →

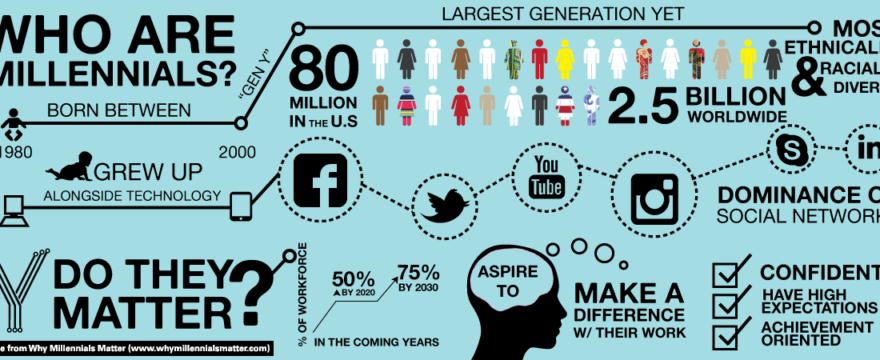

More Young Millennial Adults Choosing to Live With Parents.

According to the Urban Institute (a nonprofit research organization in Washington DC), the percentage of young adults between 24 and 34 who are living with their parents has risen more than 10% …

Continue Reading about More Young Millennial Adults Choosing to Live With Parents. →

Think You’ll Save Money Going to Your Credit Union? Just Ask THIS Borrower!

When it comes to mortgage rates, there’s a perception that borrowers can shop for the best rates. The truth is there is little difference from one lender to another. And since closing …

Continue Reading about Think You’ll Save Money Going to Your Credit Union? Just Ask THIS Borrower! →

Buying a Home? Top 5 Questions to Ask Your Realtor

Last updated 2/24/2020 Congratulations! You’ve made the decision to buy a home! Most people will start by looking at houses on-line and going to open houses. But SHOPPING for a home is different …

Continue Reading about Buying a Home? Top 5 Questions to Ask Your Realtor →