THE SCENARIO: Martha and Mary—lifelong best friends and devoted moms—are both navigating divorce. Like many, they paused their careers to focus on raising children. Now, their top concern is providing stability: keeping their kids in the same home, neighborhood, and school.

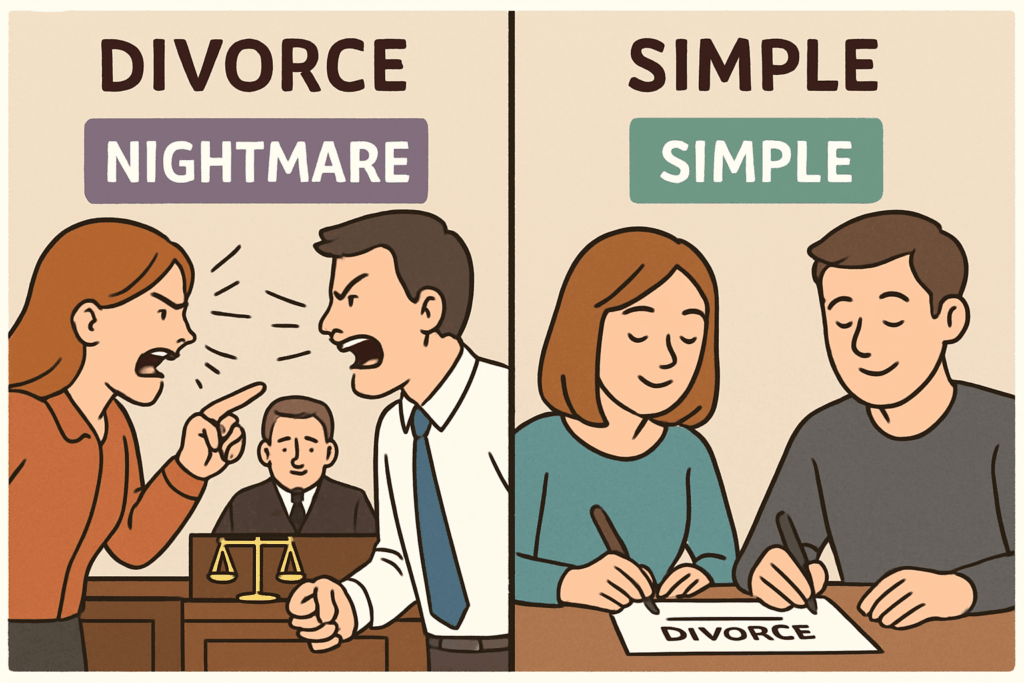

THE PROBLEM: Martha’s attorney negotiated what seemed like a solid agreement: child support, alimony, and a clause requiring her to refinance the home within six months to remove her ex from the mortgage and buy out his equity. With the judge’s approval, everything appeared settled.

Until her mortgage was denied.

Why? Most lenders require six months of documented support payments before using that income to qualify. No one told her. With the clock ticking, Martha was forced to either breach the agreement—or accept a costly mortgage that strained her finances. Trust broken. Budget wrecked.

A BETTER SOLUTION: Mary’s story? Entirely different!

Her attorney assembled a team: a financial advisor, a CPA, and a mortgage strategist (me!). We reviewed the deal before it was finalized and adjusted the timeline—giving Mary twelve months to refinance. Her mortgage was approved smoothly. No stress. No surprises.

BOTTOM LINE: Divorce settlements aren’t just legal documents; they’re financial lifelines. One overlooked clause can cost your client their home, stability, or peace of mind.

If you’re a family law professional, protect your clients—and your reputation—by involving experienced financial partners early. And if you’re going through a divorce yourself, make sure your team is speaking the same language.

Because in life’s most important transitions, coordination isn’t a luxury, it’s a necessity!

______

Warren Goldberg is President of Mortgage Wealth Advisors, a Certified Mortgage Planning Specialist®, and a published author. His interviews include Blog-Talk Radio, Newsday, The Daily News, Anton Press, and the Long Island Herald. Since 1992, he’s been sharing his financial knowledge and wealth-building strategies, including how to properly use your mortgage as a financial tool. His clients regularly express their trust and appreciation by recommending friends and family call when in need of mortgage, real estate, and financial guidance.

Leave a Reply