With prices continuing to rise, did you know you can take advantage of a temporary lower rate to help acclimate to your payments? The market is filled with first-time buyers anxious to own a home, …

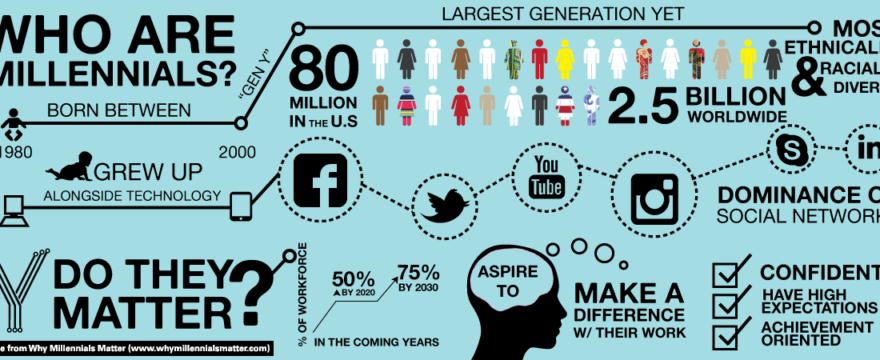

More Young Millennial Adults Choosing to Live With Parents.

According to the Urban Institute (a nonprofit research organization in Washington DC), the percentage of young adults between 24 and 34 who are living with their parents has risen more than 10% …

Continue Reading about More Young Millennial Adults Choosing to Live With Parents. →

Buying a Home? Top 5 Questions to Ask Your Realtor

Last updated 2/24/2020 Congratulations! You’ve made the decision to buy a home! Most people will start by looking at houses on-line and going to open houses. But SHOPPING for a home is different …

Continue Reading about Buying a Home? Top 5 Questions to Ask Your Realtor →

5 Critical Factors You MUST Consider When Shopping For a Home and a Mortgage

For most Americans, homeownership is the American Dream and has provided the cornerstone to building wealth. Yet countless Americans shop for a home and then a mortgage without …

FICO or FAKO?? The Credit Score You’ve Obtained May Not Be So.

This article inspired and edited from an article published by Alan Hayon, Founder and CEO of The Credit Desk (www.TheCreditDesk.com) in Great Neck, New York. Many consumers preparing to purchase a …

Continue Reading about FICO or FAKO?? The Credit Score You’ve Obtained May Not Be So. →

Down Payment Misconceptions Hinder Millennials From Owning a Home

Misconceptions about down payments continue to hinder millennials from owning a home. Industry professionals at a recent Mortgage Bankers Conference cited …

Continue Reading about Down Payment Misconceptions Hinder Millennials From Owning a Home →