Prospective homebuyers may be in for a nasty shock if mortgage interest rates ever return to their “normal” pre-crisis levels.

After a few years of super-low rates, a vast majority of homebuyers think sub-5% mortgage interest rates are normal, according to a recent study released by the Redfin Research Center.

In this recent survey, internet real estate brokerage Redfin asked prospective homebuyers what they considered a “normal” interest rate for a 30-year fixed-rate mortgage. A combined 83% of respondents expected a normal rate to fall under 5%! Even more surprising is that both seasoned and first-time buyers think a rate below 5 percent is “normal!”

To put this in perspective:

- Interest rates have averaged around 6.7% since 1990.

- Rates never once fell below 5 percent until March 2009.

- In the 1980s, rates bounced around between their lows of around 10% to as high as 18%! Mortgage rates were never anywhere near 5%!

“Clearly, the Fed’s easy-money policies since the housing crash have trained buyers to expect mortgage rates that start with threes and fours,” wrote Redfin’s Ellen Haberle in the report. Homebuyers are also exhibiting “a high degree of intolerance toward mortgage rate fluctuations,” Haberle reported, more than 40% of survey respondents said they wouldn’t buy a home if rates rose much further!

That’s bad news for a Fed looking to taper its $85 billion-per-month bond-buying program while keeping economic recovery rolling. When the Fed tapers, rates will rise. This could further stall mortgage lending. In fact, simply the threat of a possible September taper caused rates to spike by more than a full percentage point over the summer, strangling the refi boom and prompting big lenders to lay off thousands of mortgage employees.

The bottom line seems to be this:

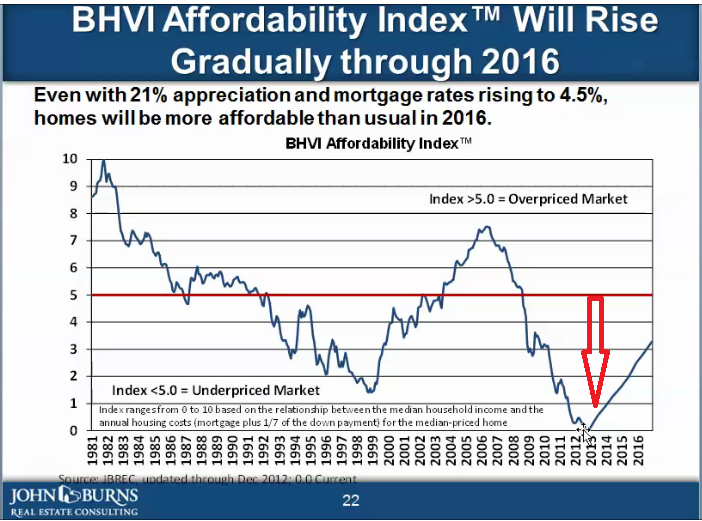

Americans have purchased homes regardless of whether mortgage rates were in the teens or below 5%. The BHVI Affordability Index (shown above) clearly shows that NOW is the best time in decades to purchase a home. Since rates are likely to rise in the new year, if you’re contemplating a home purchase and want a rate below 5%, you had better stop procrastinating and get serious about your home search.

Put your trust in a seasoned and Certified Mortgage Planning Specialist with a proven track record. By consulting with me well before you find your new home, we can ensure your transaction goes smoothly, your mortgage complements your financial plans, and helps you attain your financial goals.

And guess what? The mortgage interest rates and fees you’ll receive are probably about the same as if you went to “Your Bank.”

Warren Goldberg is President of Mortgage Wealth Advisors, a Certified Mortgage Planning Specialist®, and a published author. His interviews include Blog-Talk Radio, Newsday, and the Long Island Herald. Since 1992, he’s been sharing his financial knowledge and wealth-building strategies, including how to properly use your mortgage as a financial tool. His clients regularly express their trust and appreciation by recommending friends and family call when in need of mortgage, real estate, and financial guidance.

_____________________

Redacted from:

Mortgage Professional America, Mortgage Rate Misconception Abounds, by Ryan Smith, 12/12/13

Redfin Research Center, 83% of Homebuyers Think a Mortgage Rate Below 5% is Normal, by Ellen Haberle, 12/09/13

Leave a Reply